Market Correlations

Market correlations refer to the statistical relationships between the price movements of different assets or markets. Understanding market correlations can help traders and investors assess how various assets or markets tend to move in relation to each other. Correlations can be positive, negative, or neutral, and they provide insights into diversification, risk management, and trading strategies.

Here’s how you can understand which parts of the markets are correlated:

- Correlation Coefficient: The correlation coefficient, often denoted as “r,” quantifies the strength and direction of the relationship between two assets or markets. It ranges from -1 to +1:

- +1 indicates a perfect positive correlation, meaning the assets move in the same direction.

- -1 indicates a perfect negative correlation, meaning the assets move in opposite directions.

- 0 indicates no correlation, implying that there is no consistent relationship between the assets.

- Correlation Matrix: To analyze correlations across multiple assets, you can create a correlation matrix. In a matrix, each asset is compared with every other asset, and correlation coefficients are calculated. This matrix provides an overview of how different assets are related to each other.

- Using Financial Tools: Many financial platforms and tools provide correlation analysis. You can input the assets or markets you’re interested in, and the tool will generate correlation coefficients. Examples of such tools include Bloomberg, Reuters, and various charting software.

- Research and Analysis: Keep an eye on economic and financial news that may impact different asset classes. For example, interest rate changes, geopolitical events, or economic data releases can influence various markets. Understanding the fundamental factors that affect different assets can help you anticipate correlations.

- Technical Analysis: In technical analysis, traders often look for patterns or trends in price charts. If two assets exhibit similar chart patterns or tend to move together over time, it may suggest a positive correlation.

- Macro Factors: Consider macroeconomic factors like inflation, interest rates, and economic growth. These factors can influence multiple markets simultaneously. For example, rising interest rates might impact both stock and bond markets.

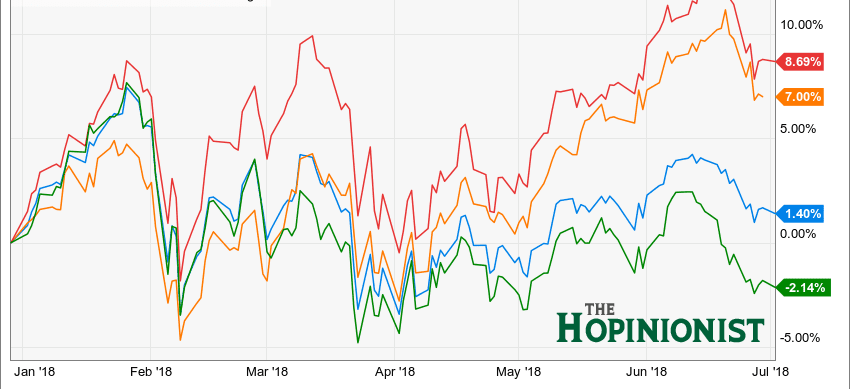

- Historical Data: Analyze historical price data to identify past correlations. Be aware that correlations can change over time due to changing market conditions and external factors.

- Risk Management: Understanding correlations is vital for diversification and risk management. Assets with negative correlations may provide a hedge against each other, helping to reduce overall portfolio risk.

Remember that correlations can change, and past performance is not always indicative of future behavior. Markets are influenced by a wide range of factors, and correlations can shift in response to changing economic conditions, news events, or market sentiment. Therefore, ongoing analysis and monitoring are essential for staying informed about market correlations and adjusting your trading or investment strategies accordingly.

Additional Insights

- Timeframes: Correlations can vary depending on the timeframe you’re analyzing. Short-term correlations may differ from long-term correlations. For example, two assets may have a positive short-term correlation but a negative long-term correlation due to changing market dynamics.

- Causation vs. Coincidence: Be cautious about assuming that correlated movements imply causation. Just because two assets move together doesn’t necessarily mean one is causing the other to move. It could be a coincidence or driven by external factors affecting both.

- Changing Market Conditions: Market correlations can change abruptly. For example, during periods of extreme market stress or sudden economic events, correlations may shift as investors reassess their portfolios.

- Diversification: Understanding correlations is essential for diversifying your portfolio effectively. Diversification seeks to reduce risk by investing in assets that are not highly correlated. A well-diversified portfolio may include assets with a mix of positive, negative, and neutral correlations.

- Risk Management: Correlations can help you manage risk by identifying assets that may move in the opposite direction during market downturns. This can be particularly important for investors looking to protect their portfolios in turbulent times.

- Use of Derivatives: Some traders and investors use derivatives such as options and futures to hedge against correlated movements. For example, they may buy put options on an asset to protect against potential downside while maintaining exposure to another asset with a positive correlation.

- Correlation vs. Cointegration: It’s essential to distinguish between correlation and cointegration. Cointegration refers to a long-term statistical relationship between two assets, suggesting that they move together over time. Cointegration is often used in pairs trading strategies.

- Quantitative Analysis: Advanced quantitative techniques, such as regression analysis or machine learning models, can help you explore and understand correlations in-depth. These methods can identify underlying relationships and factors driving correlations.

- Economic Events: Pay attention to economic events, central bank policies, geopolitical developments, and news releases. These events can impact correlations. For example, an unexpected interest rate decision can influence both currency and bond markets.